How to Manage Passive Income Streams - SoFi

The 2-Minute Rule for Why Passive Income Beats Earned Income

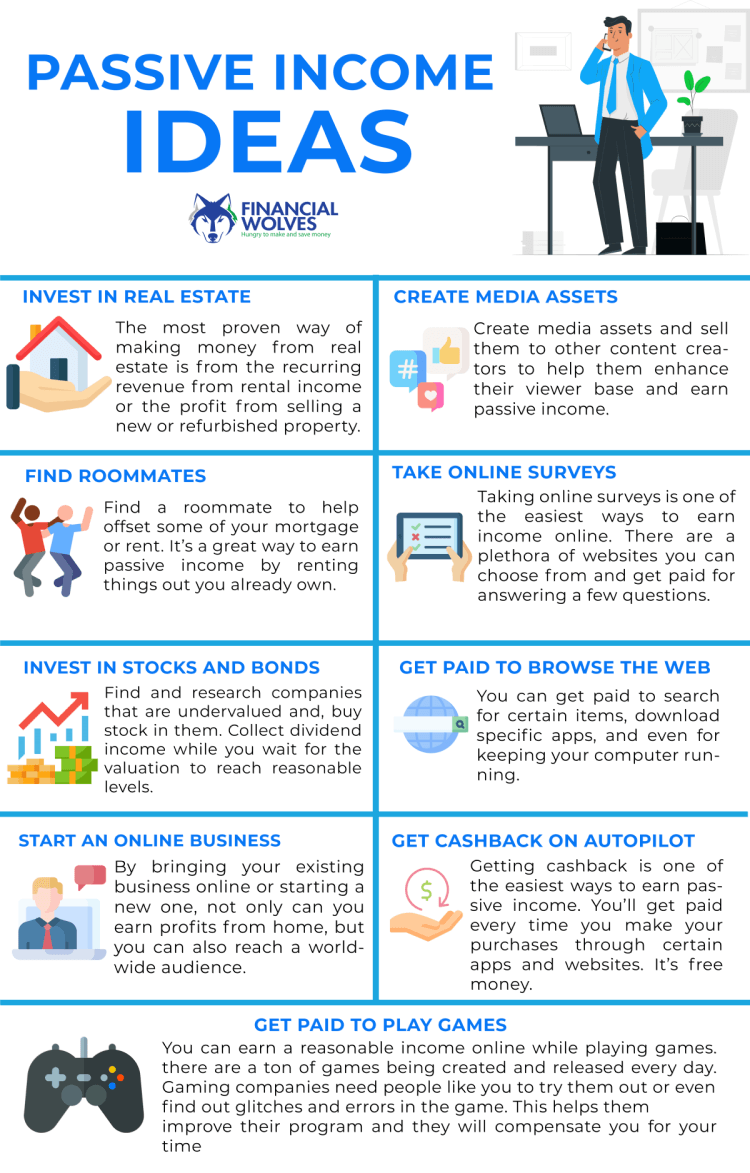

If you're a forward-focused thinker, you may be dreaming about leaving the labor force to take pleasure in an easier life in retirement or you may even be considering retiring early. But a dream without a plan is just a desire. To put Keep Checking Back Here on that dream, you require to think about passive income. There are a lot of various passive earnings alternatives and explanations of how to develop it. If you're brand-new to the concept, we're about to break it down for you. Passive income is cash you make in such a way that requires little to no daily effort to preserve. Some passive earnings ideaslike leasing out home or constructing a blogmay take some work to get up and running, but they could eventually earn you cash while you sleep.

You understand what we're talking about! Even if you like your job, we're ready to wager you would not mind making some extra earnings without the blood, sweat, tears and time commitment of another task. Here's what constructing a passive earnings can do for you: Increase your wealth-building plan Develop a chance to retire early Safeguard you from a total loss of earnings if you lose your job Supply an extra income when you're no longer able to work or if you outlast your retirement fund Passive income generally will not make you wealthy over night, so forget about any get-rich-quick plans you have actually become aware of.

We're talking anywhere from a couple of thousand dollars to numerous countless dollarsdepending on the income stream. Passive income can be constructed in lots of methods, but initially let's take a look at what it truly is and which earnings streams are available. When we say "passive income," some people tend to consider investing due to the fact that it can produce the largest results with the least amount of work. But your retirement plan and passive earnings should be believed of as two different things. The whole idea behind long-term investing is to develop earnings for retirement. You want to ensure you're buying your company retirement plan, like a 401( k) if your fund options are excellent and they provide a matchin addition to other tax-favored strategies like a Roth IRA if your company does not provide a Roth 401( k).

UNDER MAINTENANCE